Our Services Tab & Sub

BPO Accounting and Bookkeeping Services

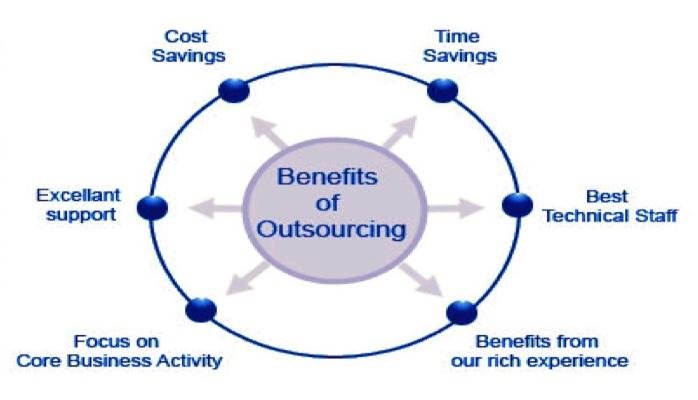

At David O & Associ ates, we provide high-quality, cost-effective and result-oriented accounting & Finance services to our clients that help them focus on their core businesses. Our services include full service accounting from order-to-cash, procure-to-pay, record-to-report, decision support and cash flow management along with tax prep, reporting and IRS tax resolution, audit support and more. We offer complete and scalable Online Accounting Services, giving you the big picture reports to help you optimize your business decisions. We are mindful of your business needs and increasing profitability. We assign dedicated teams of on and offshore virtual accountants who work together to address all of your accounting needs. We accurately generate timely all-inclusive financial summaries of your accounting records and ensure you get relevant and accurate information when you need it. We streamline your accounting processes and help you improve your organization’s efficiencies to help drive profits.

At David O & Associ ates, we provide high-quality, cost-effective and result-oriented accounting & Finance services to our clients that help them focus on their core businesses. Our services include full service accounting from order-to-cash, procure-to-pay, record-to-report, decision support and cash flow management along with tax prep, reporting and IRS tax resolution, audit support and more. We offer complete and scalable Online Accounting Services, giving you the big picture reports to help you optimize your business decisions. We are mindful of your business needs and increasing profitability. We assign dedicated teams of on and offshore virtual accountants who work together to address all of your accounting needs. We accurately generate timely all-inclusive financial summaries of your accounting records and ensure you get relevant and accurate information when you need it. We streamline your accounting processes and help you improve your organization’s efficiencies to help drive profits.

Our clients enjoy a wide range of benefits such as:-

- Up to 45% cost savings

- Flexible menu of services to fit needs and budget

- Convenient and secure web-based workflows

- Improved visibility that helps informed decision making

- Best practices that yield measurable process improvements.

- Dedicated professional teams

Your dedicated team will include a Full-charge bookkeeper, an Accounting Manager and/or Controller and Accounting Software Specialist.

These teams, starting with the full charge bookkeeper are responsible for daily entry of accounting transactions including vendor bills, customer invoices, bill payments, customer payments and deposits, other disbursements and withdrawals. The bookkeeper also maintains complete and up-to-date detailed accounts receivable, accounts payable and cash account ledgers and provides daily and weekly reports on these and other critical areas of business management pursuant to service level agreement.

Services

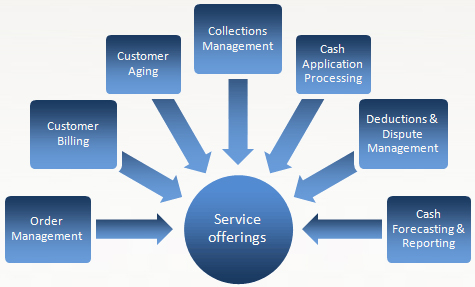

Accounts Receivables (invoices and collection)

David O & Associates is dedicated to maximizing the efficiencies and saving you valuable time in the process so that you can focus on growing your business. We work hard to maximize your cash-flows by optimizing your Accounts Receivable process so that you don’t have to worry about the financial operations of your business.

David O & Associates is dedicated to maximizing the efficiencies and saving you valuable time in the process so that you can focus on growing your business. We work hard to maximize your cash-flows by optimizing your Accounts Receivable process so that you don’t have to worry about the financial operations of your business.

Our Accounts Receivables Services include:-

- Order Management

- Customer Billing

- Cash Management

- Bad Debt Analysis

- Credit Review & Analysis

- Ledger Maintenance

As such our Accounts Receivable Solutions enable you to:

- Reduce Days Sales Outstanding (DSO)

- Reduce cash collection shortfalls

- Reduce A/R adjustments and bad debt write-offs

- Gain visibility into receivables transactions

- Focus on your core business activities (rather than being stuck in back-office processes)

- Ensure more effective credit control

- Maintain healthier accounts by lowering the revenue costs

- Rectify unallocated cash values

- Reduce the operational costs as well as overheads

- Access flexible workforce for quick and easy decision making in order to meet business requirements

- Access more consistent customer interaction and communication which ultimately enhances your customer base

- Maximize collections by offering extensive Credit control

- Improve the overall productivity

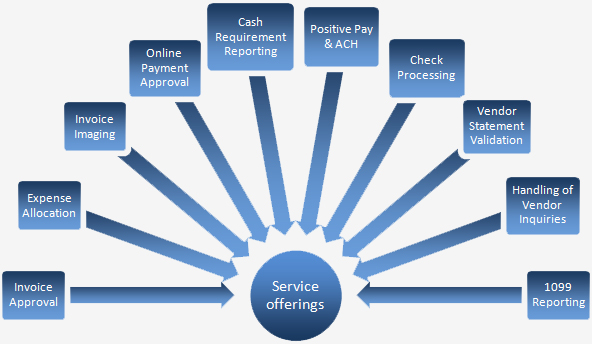

Accounts payable (bills and payments)

David O & Associates believes in delivering efficient and effective accounts payable outsourcing services to help businesses optimize profit margins. Our account payable outsourcing team is dedicated to take your business from conventional accounts payable solution to completely paperless accounts payable automation services. Get that stack of invoices off your desk and focus instead on the tasks that get more revenue rolling into your business. With our partnership, David O & Associates can implement a complete procure-to-pay process that maximizes payment discounts and helps you avoid penalties. We’ll transform your paper-based A/P into an electronic workflow that enables you to see exactly what you’re purchasing and decide who and when to pay.

We have designed our Accounts Payables services to enable you to:

- Maximize Profit—The first and foremost benefit of outsourced accounts payable is that it helps to enhance the working capital of the business and ensures its optimal use.

- Reduce Processing Costs— With the help of Accounts payable automation, you can easily reduce the cost of processing. It helps in minimizing the total time required to complete the transaction.

- Access Invoice Documents via the Web— It allows you to access the invoice online, making it convenient for you to access it from any corner of the world.

- Avoid Late Payment Fees and Penalties— Reminders and scheduling facility keep you up to date about your future payments and gives you the freedom from late payment penalties.

- Never Miss an Early Payment Discount— Simultaneously, it rewards you the benefits of early payments by updating you about the profits of early payment, if any.

- Avoid Duplicate Payment— Outsourcing accounts is done by experienced professionals which mitigates the possibilities of duplicate payments.

- Eliminate The Need for Paper Invoice Storage—It becomes substantially easier with the help of accounts payable software, a paperless accounts payable system which maximizes efficiency and effectiveness.

- Improve Consolidation— It streamlines the complete accounts payable system, making it accurate and ensures high quality standards.

Month-end Processing & Financial Reporting

Your business success hinges on your ability to connect the dots, identifying trends and reacting with the correct decisions. We provide you with the tools to advance your business to the next level by way of Financial Reporting. This empowers you to see through a clear picture of the future possibilities of your business and analyze the path to improve profitability. It empowers you to beat the increased competitiveness with the help of a sturdy financial management.

David O & Associates will streamline all your financial reporting so you can review easy-to-understand P & L, Cash Flow Statement and Balance Sheet earlier and respond much more quickly each month.

Your financial reporting statements are prepared with industry leading accounting technology and made available to you immediately through our Cloud-based work-flow system. Our financial reporting solution includes: -

- Profit & Loss Statements- Empowers you to take your business to next level of success, our financial outsourcing services are focused to provide you easy to understand P&L statements so that you don't have to revisit and consult your finance managers

- Balance Sheet- Enables you to keep an eye on every transaction of your business and manage the incoming and outgoing of the company’s funds

- Cash Flow Statement-Assists you in maximizing the utility of your cash, and provides you insights about how exactly it is being utilized

- Inter-Company Accounting & Balancing- Helps to make accounting services seamless, even if it involves inter-Company transactions

- General Ledger Maintenance & Posting – Our teams will perform the GL maintenance including Chart of Accounts, Vendor and customer master files, entry postings to enable you focus on your business

- Cost Accounting- Empowers you with the accurate knowledge of costs incurred in all the business transactions

- Budgeting- Enables you to take into account every future possible transaction and prepare for it.

- Forecasting- Helps you transform into a proactive decision-maker who understands how varying factors are affecting his business.

- Fixed Assets Account Management- It is a difficult task to accurately measure the exact market value of your fixed assets. And for a small scale growing business, it is crucial to do it accurately so that they can be utilized for meeting funding needs through various channels such as bank loans, letter of credit etc.

- Corporate Consolidation- Assists you by aggregating financial statements of group companies as financial consolidated statements

- External Reporting- Updates you about the pros and cons of your business decisions

Management Consulting & Decision Support

Decision making starts with identifying the problem, selecting key objective, analyzing every possible solution, evaluating the different scenarios and ultimately making the decisions best suited for your business.

As a business leader, effective decision-making skills are essential for entrepreneurs and are differentiator between businesses with ordinary growth trajectory vis-à-vis the ones focused towards long-term success.

There are myriad factors that are taken into consideration while deciding on the objectives of the business. But, before coming to a conclusion, the decision-makers take out every bit of information to make it more focused and accurate. This information covers every aspect of business and includes research and analysis reports of various topics in the market, be it Human resources, Administration, Operations, or Financial services. Everything has to be done with proper planning and strategy.

Accordingly, when you’ve got important business decisions to make, your financial services consulting team at David O & Associates, can dig deeper into your data to perform complex analysis and provide advisory services.

- New Business Due Diligence– Our consultants provide you with an accurate competitive pricing analysis which is necessary to help your business gain a winning edge and beat all the possible competition coming your way.

- Business Performance Analysis – Provides you with consistent business performance analysis so that you can rigorously analyze your business model, suggest process improvement options in its operational system, and transition to more efficient standard operating procedures for more effective functioning of your business.

- Revenue/Cost Analysis – This service will help you enhance the profit margin by decreasing the cost of production and maintenance. We understand that the profitability of the business depends upon the revenue generation model of the business, and thus it is a crucial task to analyze the exact cost incurred by the business for different processes and services. The lesser the cost, more will be the profitability!

- Strategic Plan Support – To help you evolve your business and steer clear of the cut throat competition. Planning a strategy requires a lot of industry-expertise, a wide spectrum of knowledge, and broad prospective to experiment with innovative ideas. Our strategic plan support team for finance and accounting solutions helps you make crucial business decisions that require complex financial modeling and statistical and project decision analysis including ratio analysis, EVA, NPV, IRR, Discounted Cash-flow and related support functions. Our team deeply understands the industry and the requirement of your business so that we can assist you with the best-possible strategic plan for its efficient operation and long term growth.

Account/Bank Reconciliations

- Balance Sheet Reconciliations

- Bank Reconciliation

- Daily Cash Positioning

- Cash Forecasts

- Cash/Treasury Management

- Sales & Cash Deposit Verification

Business Tax Services

David O & Associates has experience working with Businesses (Corporations, partnerships, Sole Proprietorships and Not for Profit) to assist them with all of their tax planning and tax preparation needs. We stay current of tax laws and provide tax planning services throughout the year and ensure you take advantage of ALL available Tax Incentives. When it's time to file tax returns, you provide the information and we do the rest. You will rest assured that your tax returns are prepared accurately and filed on time.

Our tax services include:

- Preparing Federal and State Income tax returns for Businesses and Individuals including e-file

- Tax planning and analysis

- Tax alternatives and ways to reduce your taxes

- Preparing Property Tax Returns

- Quarterly & Annual State and Federal Employment / Payroll Tax (SUTA and FUTA)

- Tax Audit assistance

- General Audit Support

- Tax Compliance and Consulting Services

- Business Tax Compliance and Consulting Services

IRS Tax Resolution services

The IRS will take collection action, and taxpayers shouldn't face the IRS without proper qualified representation. We represent clients in individual and business back taxes to get them the best possible resolution and preserve your peace of mind. Our services include:

- Offers in compromise

- Installment agreements

- Penalty abatement

- Innocent spouse claims

- Injured spouse claims

- Bankruptcy tax analysis

- Currently non-collectible status

- Unfiled tax returns

- Amended tax returns

- Bank account levies

- Wage levies

- Tax liens

- Property seizures

- Payroll tax matters

- Trust fund recovery penalty case

Monthly Financial Report Package

- Balance Sheet

- Profit and Loss Statement – Month

- Profit and Loss Statement – YTD

- Profit and Loss Statement by Class – Month

- Profit and Loss Statement by Class – YTD

- Cash Flow Statement

- Accounts Receivable Aging

- Accounts Payable Aging

- Prepaid Expenses by Vendor

- Accrued Expenses by Vendor

- Deferred Revenue by Customer

- Open Sales Order by Customer

- General Ledger

Other Advanced Services:

Budgeting & Forecasting Financial statements & custom reporting Fixed asset management 1099 forms Coordinating with your CPA or tax adviser Tax & Audit support

Audit Support

David O & Associates provides expert resources in audit readiness activities needing to achieve financial statement audit readiness in accelerated timeframes, CSCI is well equipped to support this mission-critical effort. Audit support includes Reviews and Compilations of Provided By Client (PBC) lists financial records and supporting documentation to auditors, assisting in the development of process cycle memorandums, procedural walk-throughs, and responding to various inquiries to assist the auditor with the development and documentation of their work papers. ARC also participates in any scheduled or requested audit status meetings.

- Complete support from the beginning

- Support in the event of an audit

- Custom, detailed audit reporting

- Responsive customer service

Controller Services

Our outsourced controller services are customized to suit the needs of growing businesses. Our expertise allows great flexibility that can be scaled from as low as $1 million to hundreds of millions in annual revenue. Our controllers oversee all client accounts and prove you with timely performance insights.

All our Controllers and Accounting Managers have extensive experience in financial management and controller services. They oversee all work completed by our full-time bookkeepers, close client books on a monthly or quarterly basis and provide consultations on a wide variety of client matters.

Additionally, our Controllers are also responsible for:

- Management of accounting and bookkeeping processes

- Budgeting and forecasting

- Cash flow management and projections

- Accounting documentation, including processes, procedures and operations manuals

- Job costing and inventory tracking

- Reporting and oversight of month-end closings

- Audit preparation and advisory services

- Management of accounting and bookkeeping processes

- Fixed Assets Accounting

- Statutory Reporting and Tax Prep and filing – Federal, State and local

Other Client Specific Needs Such As:

Inventory, Capital Assets, Prepaid Expenses, Accrued Expenses, Accrued Payroll, Deferred Revenue, Work In Process (WIP), Compensation Programs (salary and incentive), Bonus and Commission Plan Design Assistance, Cash Management, Accounting System Establishing and Maintaining, Internal Controls Establishing and Managing, Assistance with Forecasting, Customer Analysis Reports, Major Expense Analysis, Accounts Receivable and Accounts Payable Management, Shareholder Presentation Preparation, Manager Training for Understanding and Interpreting Financial Reports, Assistance with Product Pricing Decisions, Profitability Analysis for Products and Divisions, Capital Budget Monitoring, Special Report Preparation for Investors, Accounting Rules and Regulations Compliance, Trend Tracking & Profitability Analysis, Financial Trend Analysis and DCAA Compliance.